Content

Total the ChecksBe sure the checks are properly endorsed . #rpa ) with you to help you understand what you’re signing. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money. We have answers to the most popular questions from our customers.

Before working at Finder, Megan worked at Credit Karma and QuinStreet. Since the advent of smartphones, it’s become a common practice for banks to accept check deposits by using a bank’s mobile app and your smartphone’s camera.

How to Fill Out a Deposit Slip

You will find the routing number at the bottom of the slip, along with your account number if it is a pre-printed form. https://www.bookstime.com/ The routing number you use for setting up direct deposit may not be the same as the one printed on the slip.

- If you’re depositing cash, write down the full amount in the box lines next to Cash.

- However, it’s customer service lines do follow a schedule.

- Deposit cash and checks on the same deposit slip, and most banks will also let you request to receive cash if you’re depositing a check.

- Insert your ATM, debit card, or credit card into a slot on the machine.

- If you want cash back, you also may need to sign a slip too.

- Both the deposit slip duplicate and the receipt received from the bank must be kept by the depositor for future reference in case a dispute with the bank arises.

- Your bank may not always consent to give you the total amount of cash you want to receive when making a deposit.

Earn up to 1.25% APY while enjoying a suite of digital tools for smarter money management. Most banks provide pens for you to use, but you might want to bring your own just in case. Use the date of the deposit, not how to fill out a deposit slip the date written on the check. Every day, get fresh ideas on how to save and make money and achieve your financial goals. If you have any questions about this, get in touch with your bank’s customer support team.

Ways to Boost Your Financial Health (Amidst COVID-

For example, if you’re a credit union memberusing a different credit union’s branch , you’ll need to write in the name of your “home” credit union. When you fill out a deposit slip, you will enter cash amounts in one area and check amounts in another area. If you want money back, you will also enter that amount. When your bank statement arrives, compare it with your check register. Balance or reconcile your account by figuring out the amount of money you deposited, the amount you spent, and the amount you have left.

Can You Direct Deposit into a Savings Account? (And Should You?) – Yahoo Finance

Can You Direct Deposit into a Savings Account? (And Should You?).

Posted: Sat, 19 Mar 2022 07:00:00 GMT [source]

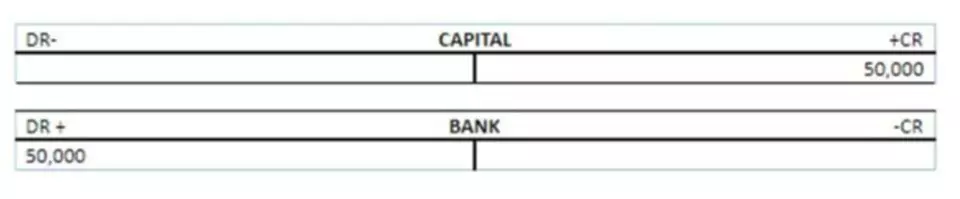

We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. A deposit is the upfront payment made before the sale is completed. Payment is the transfer of one form of goods, services, or financial assets in exchange for another form of goods, services, or financial assets.

Part 2 of 2:Filling Out Your Deposit

That’s why it’s vital to keep your deposits accurate. If you prefer to direct deposit to a savings account but don’t have one set up, consider some of the vendors below to find an account for your saving and spending habits. Keep reading to learn when a deposit slip is needed, what information to include, and what you’ll need to do if you discover a mistake. A deposit slip is not normally valid until it has been signed. It should also be executed at the time the deposit is being made. This is so that another individual cannot use this document to gain access to your account, should it become lost before you arrive at the bank.

Our editorial team does not receive direct compensation from our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. If you are depositing checks, you will need to endorse them.

First, ask your bank if it offers electronic deposits. If it does, a representative can take you through the steps. Earn up to 1.00% cash back on all transactions that require a signature. If math isn’t your strong suit, a calculator can be an valuable tool when adding up your cash and checks. Deposit both of these at the same time, but if your checks aren’t signed by both you and the issuer, your deposit won’t be accepted. If you’re withdrawing any cash, write that number on the cash received line.