Contents

It represents the relationship between 2 moving averages of a financial instrument’s price. MACD moves back and forth between moving averages and indicates momentum. Usually, MACD is calculated by subtracting the 26-day EMA from the 12-day EMA.

Traders should always consider the market’s liquidity and volatility before adopting a forex scalping strategy. Using leverage is an important part as well when using a scalping strategy – it helps increase the profits (don’t forget about the opposite side of the leverage). Here the price trending above the moving average gives the bullish signal. On the other hand, the price trend below the EMA line creates an opportunity for short-selling. A common mistake made by forex beginners is to think that making money with forex trading is a breeze. The truth is, that a beginner has much to learn about the market.

Some traders advise to use the New York-London session overlap; it’s when the market is the most volatile – during those few hours prices are low and liquidity is high. Sinse scalpers’ profits are low, they have to open multiple trades and work it to have something resembling profit. Due to the specifics of this kind of trading strategy traders have to open dozens of trades throughout the day and close them in a few seconds or minutes. Relative Cash Flow Statement strength index – is a momentum indicator, uses a range of between zero and 100 to assess whether the market’s current direction might be about to reverse. It uses levels of support and resistance – set at 30 and 70 respectively – to identify when the market’s trend might be about to change direction. Spreads & Transaction Costs – as we mentioned before traders should be thoughtful when choosing brokers, regarding major currency pairs spreads.

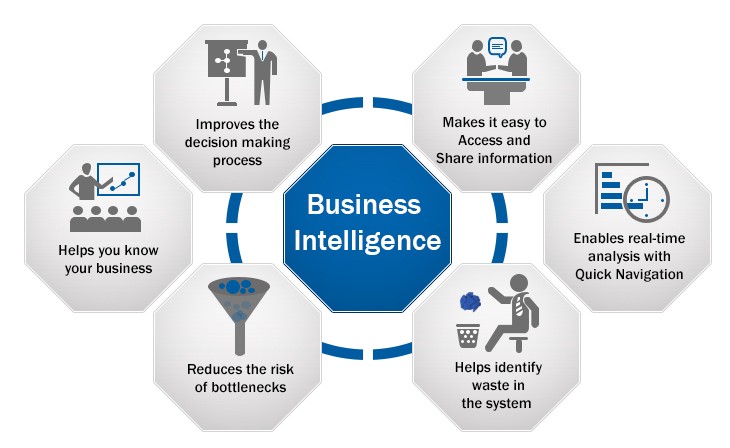

- To get an advantage over others, traders must keep an eye on various key aspects.

- Some of the best traders in the world who follow the trend following strategy are right only 40 percent of the time.

- SAR starts to move a little faster as the trend develops, and soon the points catch up with the price.

- Please be aware of the risk’s involved in trading & seek independent advice, if necessary.

- Moving average – A moving average is a mathematical formula that helps to spot emerging and common trends in markets, represented as a single line showing an average.

MOM does not move back and forth between the predetermined limits. Hence, the overbought and oversold levels need to be restored for every stock individually. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. No worries for refund as the money remains in investor’s account.” For example, adding the closing prices of a security for the previous month and then dividing the total by the number of days in the month.

Case Study: Simple Moving Average

Trading in the direction of strong trends gives you the best chance to make money in the forex market. The larger time frames (e.g. the weekly and daily) are usually the best to focus on when looking for predominant trends. Remember, we want to risk no more than $10 on the trade and we’re using a 50-pip stop loss.

Here is a simple price action Vs EMA strategy to predict the next day’s trend of the Index or Stock. Though it is an easy strategy it will provide you absolutely amazing profits. For example, MACD can be used in tracking stock loss in trading trends. If the trend https://1investing.in/ seems to be going up, you can consider exiting when the price falls beneath the line. If market prices at the start of an indicator window are too high or too low, it causes distortion. ROC is a widely used momentum oscillator that moves below and above zero.

What is the best EMA length?

Short-term traders typically rely on the 12- or 26-day EMA, while the ever-popular 50-day and 200-day EMA is used by long-term investors. While the EMA line reacts more quickly to price swings than the SMA, it can still lag quite a bit over the longer periods.

The greatest indicators for intraday trading will be discussed in this blog. A simple moving average relies on historic data to predict future trends. However, it is commonly believed that the market price is efficient and reflects all available information. In an efficient market, historical price data will not have any impact on the future direction of the asset price. Thus, the appropriateness of a simple moving average is challenged. But despite this handicap moving average trading strategies have worked well for traders.

Deep Dive, Moving average Analysis, Strength/Direction of Weizmann Forex (WEIZFOREX)

You also need discipline, proper risk management, and a profitable trading approach. A trailing stop loss can sometimes increase the profitability of a trading strategy considerably, while at the same time reducing its drawdown. On the other hand, it can also reduce profits and increase the drawdown if it’s applied to the ‘wrong’ strategy. Now that you know how to calculate pip values, the rest is pretty simple. Let’s say you’re looking at a trade setup on the EUR/USD which requires a stop loss of 50 pips.

First of all, there are two directions in which you can trade – long and short . Long positions make money when the price moves higher and short positions make money when the price declines. First of all, you need to know how much capital you want to risk per trade. It is recommended to risk less than 2% of your entire trading account per trade. Did you know, that with a spread of 2 pips, you need the market to move 12 pips in order to hit a profit target of 10 pips? At the same time, the market only needs to move 8 pips to hit a stop loss of 10 pips.

The research, personal finance and market tutorial sections are widely followed by students, academia, corporates and investors among others. SMA assigns equal weightage to all values but EMA places a higher weightage on recent values over past values. EMA is more reactive to the latest values since recent values have a larger impact on the calculation. Hence, the results from EMA are more timely and preferred among traders. 12-Day and the 26-day exponential average are regularly used by traders for short-term movements. The point worth remembering in trading a trend following strategy is that even the best traders in the world are right only 40 percent of the time.

GBP/JPY Price Analysis: Retraces after testing the 200-EMA in the 4-hour chart

With these settings, the strategy lost $250.26 (25.26%) in four years and experienced a maximum drawdown of 27.64%. You see, if you use really tight stops with extremely wide targets, you could have a very jagged equity curve, with drawdowns beyond your comfort zone. You also stand a good chance of losing money with this type of trading. Crocs are patient hunters who don’t waste energy on chasing their prey all day long.

What is the best EMA for 5 min chart?

The best moving averages for the 5-minute chart are 20 MA and 50 MA.

It can be applied to all financial securities such as shares, commodities, currencies, indices, and exchange-traded funds. Forex Scalping is a short-term strategy, the goal is to make profit out of tiny price movements. Leverage let’s traders borrow capital from a broker in order to gain more exposure to the Forex market, only using a small percentage of the full asset value as a deposit.

Simple 5 EMA Trading Systems for sure shot trading

Stochastic oscillator tracks the momentum and speed of the market and does not consider volume and price. It is used by many participants to forecast market price movements. At a very basic level, traders and analysts employ technical tools such as simple moving averages to analyze market sentiment.

A method of visualising whether an EMA is moving at a faster rate than in previous bars. It uses a linear regression analysis to plot a line of best fit to an exponential moving average of the price . The gradient of this line of best fit is then compared to the gradient of the line of best fit over a range of previous… Most major currency pairs have micro lot pip values that are either fixed at $0.10 or that are close to $0.10. This can give you a good idea of the dollar value of your targets and stop losses without touching a calculator. If you choose to only trade currency pairs with very low spreads , you will surely miss out on superb trading opportunities from time to time.

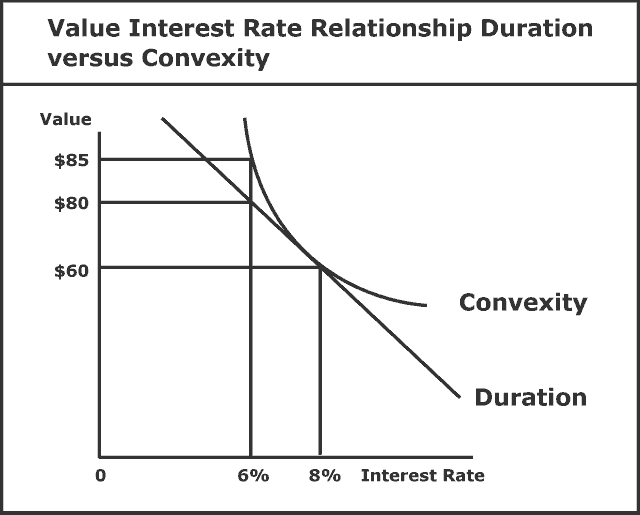

It is a clear signal that the momentum of the market price movement is decreasing. However, a drawback of longer period moving average is their lag is much more than the smaller period moving averages. Thus a trader using the longer term moving average enters a trade long after the smaller term moving average trader does. Also, exits are delayed for the longer term moving average trader.

Likewise, a 50-bar simple moving average is used to evaluate the intermediate trend. Short period simple moving averages are used to determine short-term trends. During a trend, a simple moving average may help to identify levels of support and resistance. For example, security in a long-term uptrend may fall marginally but find support at the 200-day simple moving average. Thus, the 200-day simple moving average serves as a support level and can help identify a change in trend.

Types of Momentum Indicators

As each trade carries transaction costs, scalping can result in more costs than profits. For better sensitivity, you can pick the fast-moving average of less time period, 8 or less for intraday trading. This is good for the short term, but most intraday traders pick the value of 8 or 20 to get a better interpretation of price information and to make trade decisions. So, let’s learn how to use the exponential moving average and what is the best setting for the indicator for day trading.

Conversely, the indicator displays chart positions above the price during a downward trend, signaling traders that prices are retracting. The SAR indicator helps traders determine an asset’s future, short-term momentum and assists in understanding when and where to place a stop-loss order. A moving average is a basic yet effective method of identifying a trend. Each of the columns to the right represents a simple average of the currency over a number of periods . The drop down menu labelled ‘timeframe’ enables you to define a ‘period’ as being anywhere between one minute and one month. Finally, below each moving average calculation, a buy or sell signal is displayed.

What are the 4 major moving averages?

The most popular simple moving averages include the 10, 20, 50, 100 and 200. Traders often use the smaller, faster moving averages as entry triggers and the longer, slower moving averages as clear trend filters.

A stop loss can often be a hazardous stumbling block lying just before the finish line, so to speak. You need to give your trades a fair chance of winning and at the same time cut your losses when a trade turns sour. Few things can frustrate a forex trader like being stopped out just before the market moves in your favour.

Let’s look at the different types of stop loss orders and how to use them correctly. If you’re not sure how to plot the bid and ask prices on your MT4 charts, take a look at The Essential Forex Guide and follow the 4 easy steps. This screenshot was taken from a Pepperstone Razor MT4 trading platform. Because the spread is so thin with a Razor account, we had to open a 1-minute chart for the spread to be clearly visible. One can choose 1-2 indicators to keep a track of all the entries and exits.

It makes it easier to see a pattern forming over time and helps forecast future prices. There are several types of “Moving Average” indicators, one “smoother” than the other. The smoother the moving average line the less detailed the picture that is formed and the slower to react to price movement. The “Simple Moving Average Indicator” doesn’t take spikes into account and therefore does not give as accurate a picture as the “Exponential Moving Average”.